Business Insurance in and around Uvalde

Looking for small business insurance coverage?

This small business insurance is not risky

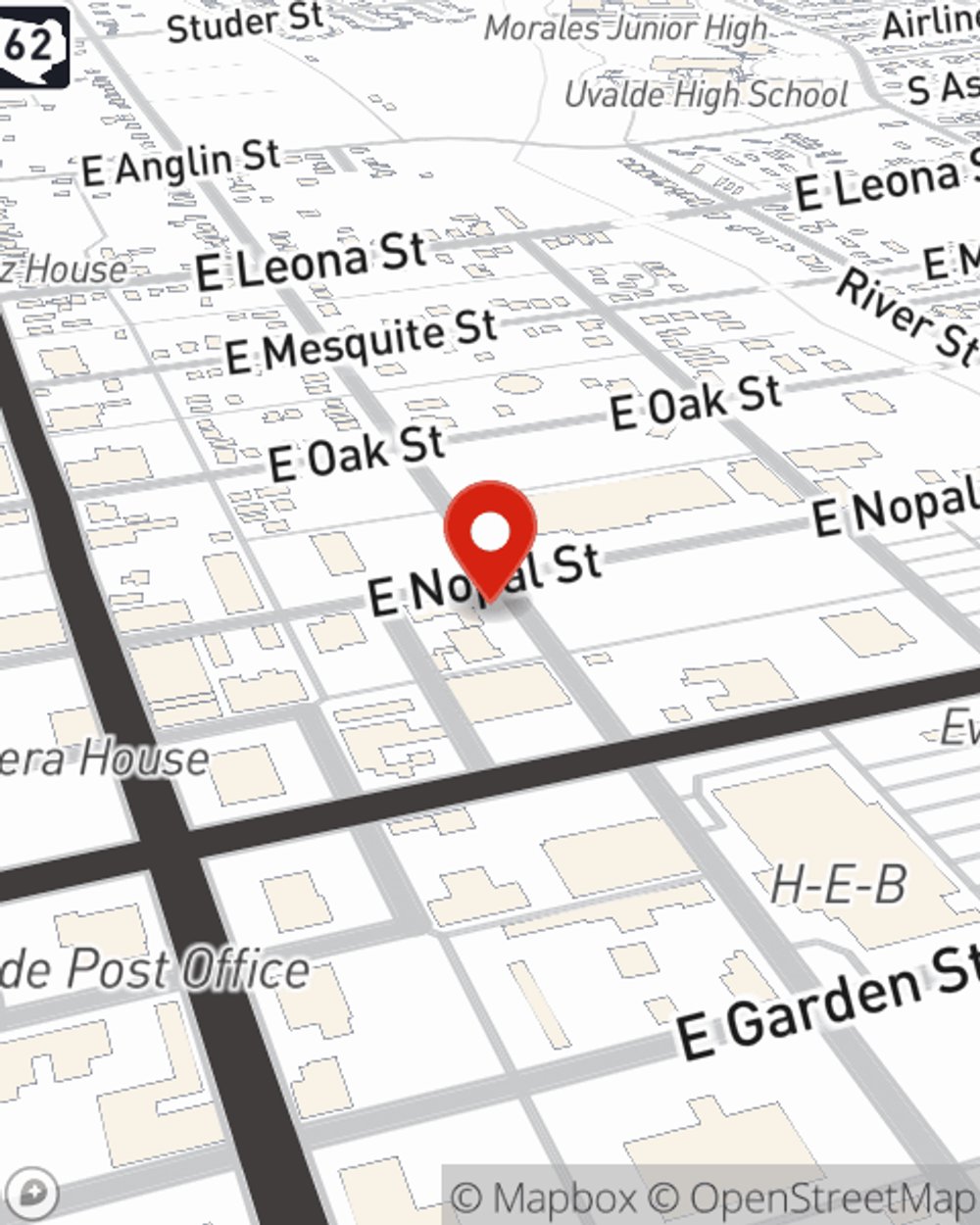

- Uvalde, TX

- Uvalde County Texas

- La Pryor, TX

- Carrizo Springs, TX

- Crystal City, TX

- Knippa, TX

- Sabinal, TX

- D'Hanis, TX

- Leakey, TX

- Concan, TX

- Camp Wood, TX

- Brackettville, TX

- Utopia, TX

- Batesville, TX

- Barksdale, TX

- Pearsall, TX

- Asherton, TX

- Big Wells, TX

- Catarina, TX

- Zavala County, TX

- Real County, TX

- Kinney County, TX

- Dimmit County, TX

Your Search For Great Small Business Insurance Ends Now.

When you're a business owner, there's so much to take into account. We understand. State Farm agent Jody Griffin is a business owner, too. Let Jody Griffin help you make sure that your business is properly protected. You won't regret it!

Looking for small business insurance coverage?

This small business insurance is not risky

Strictly Business With State Farm

State Farm has been helping small businesses grow since 1935. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a painter or a dog groomer or you own a shoe store or a donut shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Jody Griffin. Jody Griffin is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

Call or email State Farm agent Jody Griffin today to explore how a State Farm small business policy can ease your business worries here in Uvalde, TX.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Jody Griffin

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.